Understanding Corporate Performance Management (CPM) Software

Organisations that properly manage their performance data do well—really well. But the breadth of performance management, and the complexities of enterprise software involved, can spell headaches for the finance teams leading the charge.

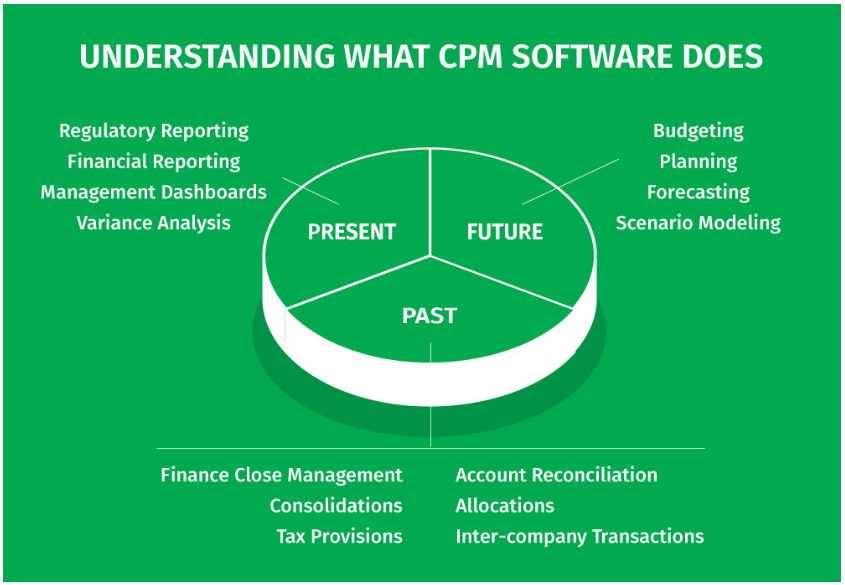

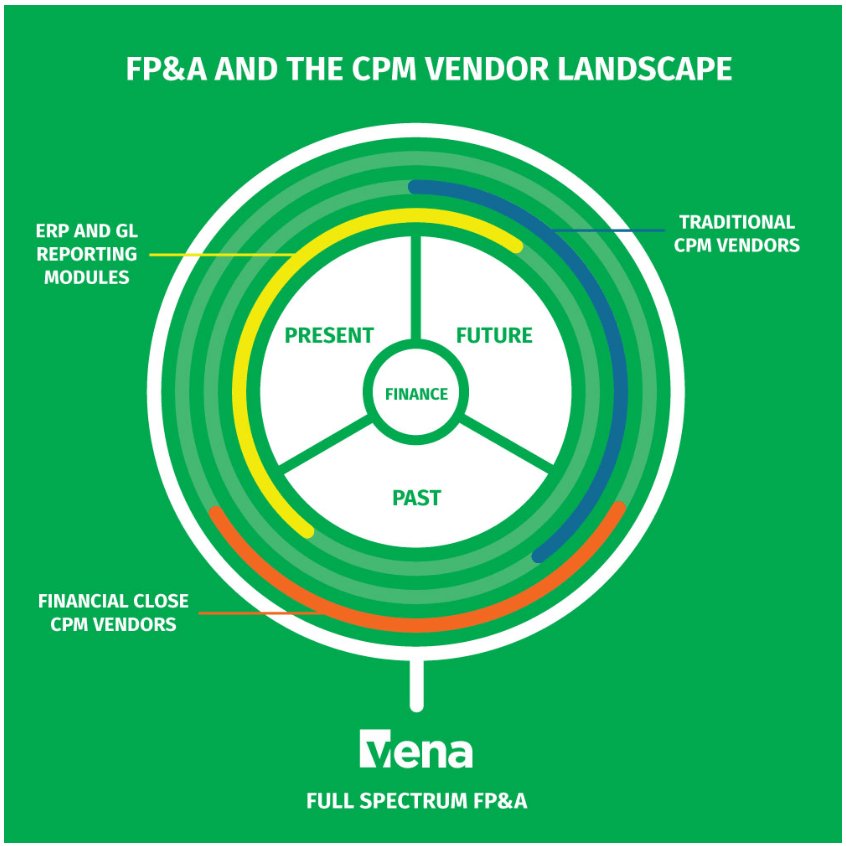

Corporate performance management (CPM) software monitors and manages the financial and operational performance of an organisation in order to set and meet corporate goals. This typically refers to metrics like return on investment (ROI), operating margins, profits and other key performance indicators (KPIs). In recent years, CPM has evolved into what’s known as full-spectrum FP&A—the idea that all past and present performance feeds into, and directly impacts, the future performance and success of a business.

Managing CPM processes with a single software platform is by far the best solution, but it’s also where the most common problems emerge. There are a number of practical hurdles when it comes to selecting the right system, so it’s important to understand the general needs that enterprise financial software solution tries to solve:

- Data accuracy: Financial information and data needs to be accurate, readily available and centrally housed, creating a single source of truth.

- Efficiency: Any software solution that an organisation chooses to implement should make life easier, not more difficult. In the case of enterprise finance software, the solution should include automation and features that give financial teams more time to spend on strategic analysis and decision making.

- Ease of use: When software is easy to use, it’s adopted by employees quicker—both in the finance department and across the organisation. The benefit of usability is twofold: more cross-departmental collaboration and quicker time-to-value.

- Inform better business planning: Numbers and accounting functions are paramount, but the next generation of corporate financial software needs to deliver more than just numbers; it must include tools to deliver key insights and help leadership make better decisions.

CPM vs. BPM vs. EPM vs. FP&A

Corporate performance management (CPM), enterprise performance management (EPM), business performance management (BPM) and financial planning and analysis (FP&A) software all piece together disparate systems to discern meaningful KPIs.

Though there are many different names and acronyms, these platforms primarily serve the same function:

- Corporate performance management (CPM): Once strictly relegated to finance departments, CPM is now employed more broadly across organizations, namely in the form of reporting departmental KPI metrics measured against targets.

- Enterprise performance management (EPM): Substituting the word “Enterprise” for “Corporate” allows the term to be applied to non-corporate organizations, but otherwise the two terms are synonymous.

- Business performance management (BPM): Essentially interchangeable with CPM, some analysts and software vendors use BPM with little or no distinction.

Modern, full-spectrum financial planning and analysis (FP&A), on the other hand, combines traditional FP&A functions with all the features of CPM software in one solution. It has become the gold standard for finance and accounting to learn from past and present company-wide data to inform better planning decisions that maximise future business performance.

Corporate Performance Management Processes

Enterprise financial software provides a framework for organisations to achieve their financial goals and objectives. The basic financial processes are:

- Budgeting, planning and forecasting: Finance teams work closely with executives and other stakeholders to determine the strategic and financial goals of the business. In many ways, FP&A teams have a direct impact on bringing all departments together to work towards a common corporate vision—but it’s not possible without understanding the economic environment and forecasting the organisation’s performance effectively.

- Financial close management: More than just the standard accounting practices where balances are gathered, adjusted and affirmed for the purposes of reporting—feeding into modern, full-spectrum FP&A, financial close practices serve as an important control point for validating budgets and forecasts against actual financial performance or forecasted numbers.

- Reporting: Reporting is an essential component to the ongoing success of an organisation. For internal stakeholders, it’s the distribution of information necessary to drive business decisions. In a regulated industry or environment, it’s required to ensure transparency and report submissions comply with myriad reporting standards.

- Modelling and analysis: Models allow analysts to test new ideas against what-if scenarios so companies are prepared for any change in internal or market conditions. Modelling is also a powerful tool to analyse profitability, determining the most profitable products and markets. Analysis is used to uncover previously unknown correlations between operating factors and business performance, and to compare the company’s actual performance with its plans and targets, identifying any course corrections needed to meet corporate goals.

CPM Software: Key Considerations

When selecting the right software solution, ease of use and adoption—along with features and functionality—are the primary considerations. Many feature-rich platforms have been hastily abandoned due to poor user experience. It’s no surprise that software users will fall back on the tech they’re familiar with when they’re presented with overly challenging options.

Functionality

If the software doesn’t do what the business needs it to do, little else matters—so it makes sense that functionality and features are often the first factors explored by teams looking to adopt a software solution.

For upwards of four decades, financial analysis has been a spreadsheet-driven process. But it’s hard to keep track of data when it’s stored in numerous Excel spreadsheets or different software systems across the company—and nearly impossible to aggregate that data into a master spreadsheet or single view. This challenge itself is often the reason why organizations seek out a CPM or FP&A solution.

Establishing a centralised, single source of truth to work from is tough, no doubt about it. But a unified view is essential to all aspects of organisational planning and reporting. And if that data can be integrated automatically, it’s possible to shave countless hours off of financial close processes—with less corrective oversight—and dramatically simplify the budgeting process altogether.

Another important consideration is version control. While change is inevitable, controlling, managing and tracking that change most certainly is not. Version control is necessary to manage data complexity and mitigate risks, from business continuity to regulatory oversight.

But data is meaningless if it can’t be communicated and understood. That’s why reporting is so vital to fulfill the informational needs of an organisation. Reporting informs action, alleviates third party audit concerns and drives strategic decision making. Without reports directing action, there’s no movement—or if there is movement, it’s risky.

Ease of Use

The ease of use in a software application has a direct impact on adoption rates. Modern computing is littered with instances of innovative technology being cast aside due to an overly complicated interface. What’s the point of investing in software if nobody’s going to use it?

Ease of use creates immediate value, because it allows the software to be adopted quickly. When business users in particular embrace a new solution, it makes the software more effective, leads to quicker wins that others in the company will notice. The next result in the value chain is buy-in and—in turn—adoption from senior management, using FP&A’s insights to drive faster, smarter data-driven decisions.

Indeed, the credibility of the finance team—even the future success of the company—can tie back to FP&A software that’s easy to use and widely adopted across the organisation.

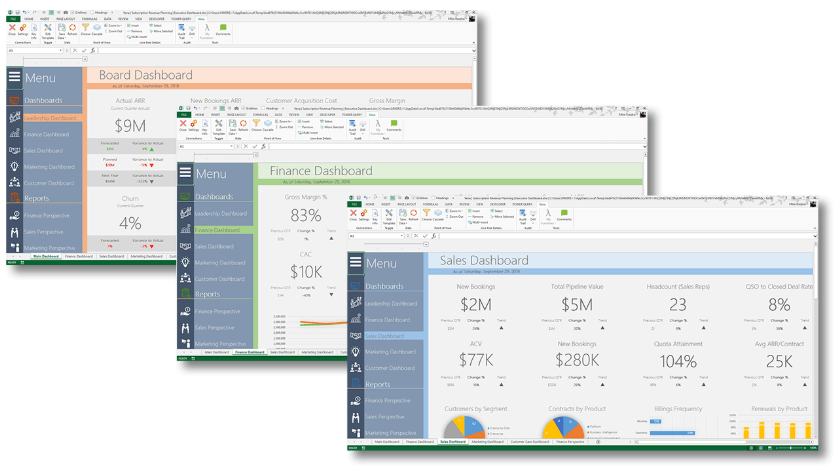

The vast majority of finance personnel are well versed in Excel, and this familiarity has a huge impact on how finance teams respond to the implementation of a new FP&A system.

Excel: Integration vs. Imitation

A running joke among finance professionals is that the most popular function of any business application is its “Export to Excel” feature. There’s no denying Excel’s versatility. Historically, it’s been used for virtually all basic finance and accounting office functions.

Excel has also been used for analysing, modeling, reporting and comparative analyses. Its place as the workhorse of the back office has been in place for at least two generations.

Despite Excel’s enduring popularity, it has distinct limitations. For one, it isn’t particularly good at communicating to a wide audience. Advances in data visualization have created audience expectations that Excel can’t easily match. Additionally, Excel presents a host of challenges when it comes to data integration and versioning. When you combine these factors with Excel’s difficulties in dealing with excessively large data sets, the answer becomes clear: it’s time for a unified solution.

The key is to embrace the versatility, usability and familiarity of Excel, while delivering on an enterprise’s need for integration, collaboration and communication. Unfortunately, many platforms fall short by trying to imitate Excel without fully capturing its power, and in the process, creating a steep learning curve for finance professionals who are already Excel pros.

The trick is to choose integration over imitation. Combining a centralised database with the ability to import and integrate different data sources from across the organisation, while delivering all of the features and functionality of Excel, is the key to maximising usability and adoption.

A Comparison of Enterprise Solutions

While most products deliver standard, baseline functionality in terms of data and reporting, the systems and their vendors diverge broadly in terms of ease-of-use, technology integration, breadth of product offering and their approach to customer care and support.

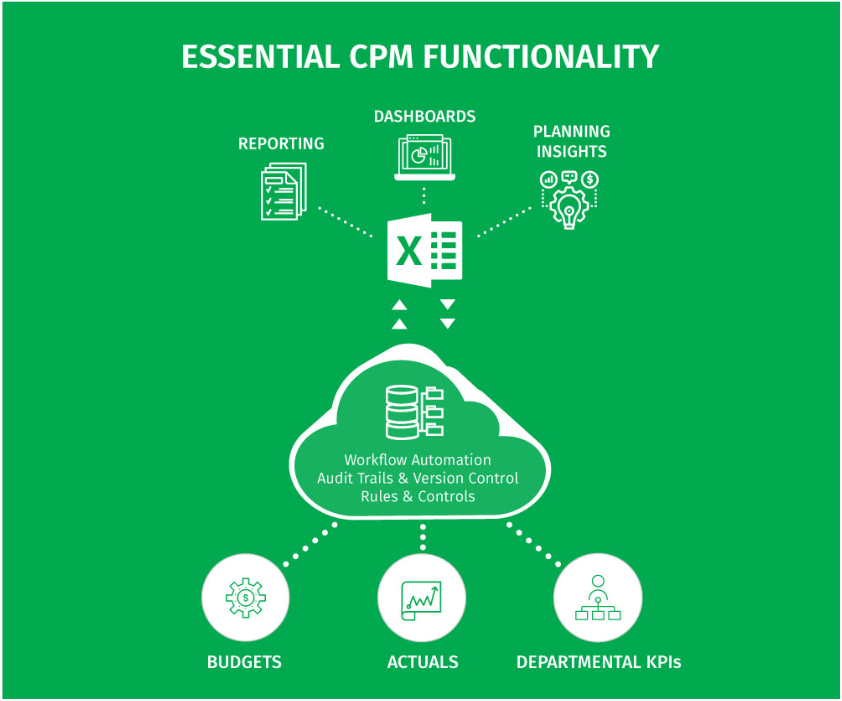

In order to understand how various solutions stack up, it’s important to first consider the essential features that any CPM, BPM, EPM, or FP&A software must include. Otherwise known as “table stakes,” these features are:

- Providing a single source of truth: All data must be housed in a centralised, multidimensional cloud database.

- Direct integration with Microsoft Excel (online and desktop): The ability to use your existing Excel spreadsheets, templates and models as part of your FP&A software is key to adoption and—as we’ve seen earlier—even better business performance.

- Integrating financial and non-financial data: Data is owned by the finance department, but includes information from across the company, with the ability to be transferred from one system to another without the need to copy and paste.

- Managing governance and control: Audit trails and version control allow you to track every change made by every user and revert back to previous versions when necessary.

- Creating beautiful, easy-to-read reports: FP&A professionals need to do more than just report the numbers—they need to tell the story behind the data. Stunning, insightful reports give FP&A teams the means to inform the right strategic decisions.

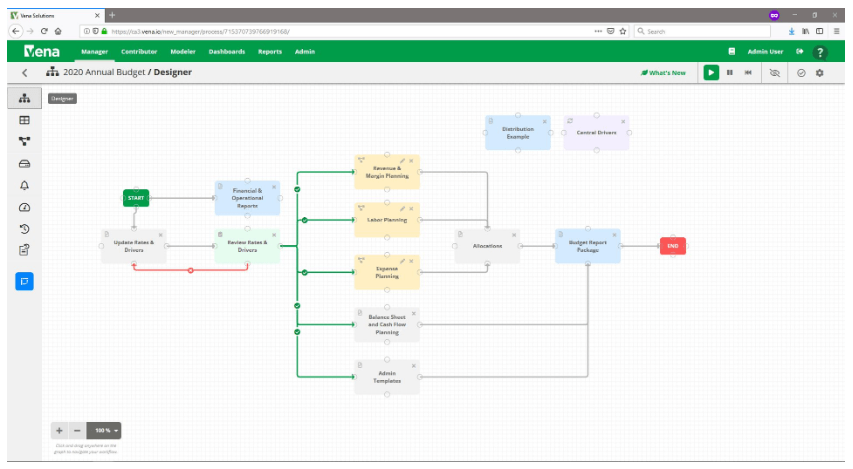

- Workflow automation: Collaboration across departments is essential, and your software needs to incorporate an automated workflow to make this collaboration quick, easy and effective.

With these table stakes universal among CPM software, resources abound to compare vendors and their product offerings. Industry analyst reports can be invaluable comparing and selecting the right CPM software, offering customer-driven, objective and third-party analysis of the market landscape and product positioning. Several leading analyst firms comparing CPM software vendors include:

- Forrester: Enterprise Performance Management Wave Report

- Nucleus Research: CPM Technology Value Matrix

- BPM Partners: BPM Pulse of Performance Management Report

Full-spectrum FP&A: The Future of CPM

Full-spectrum FP&A is rooted in finance’s focus on CPM, but goes much farther. As the following image shows, the full spectrum of FP&A encompasses what’s now available from three traditional but vastly different categories of CPM offerings, allowing companies to manage their past, present and future performance with confidence.

The right FP&A solution delivers insights that help managers make better decisions across an organisation. Technology advancements, as well as a concerted focus on ease of use, have made it easier than ever to bring the value of FP&A to all aspects of the business. The key to success starts with the right software, proving its value within finance, then using it across the organisation to maximise future performance under almost any scenario.

Looking to get started with Vena’s ground-breaking FP&A solution? Speak to a consultant at Vena’s U.K. partner Influential Software.